23 Jul

Managing 10 stores with a field team is doable.

Managing 10,000 without tech? Impossible.

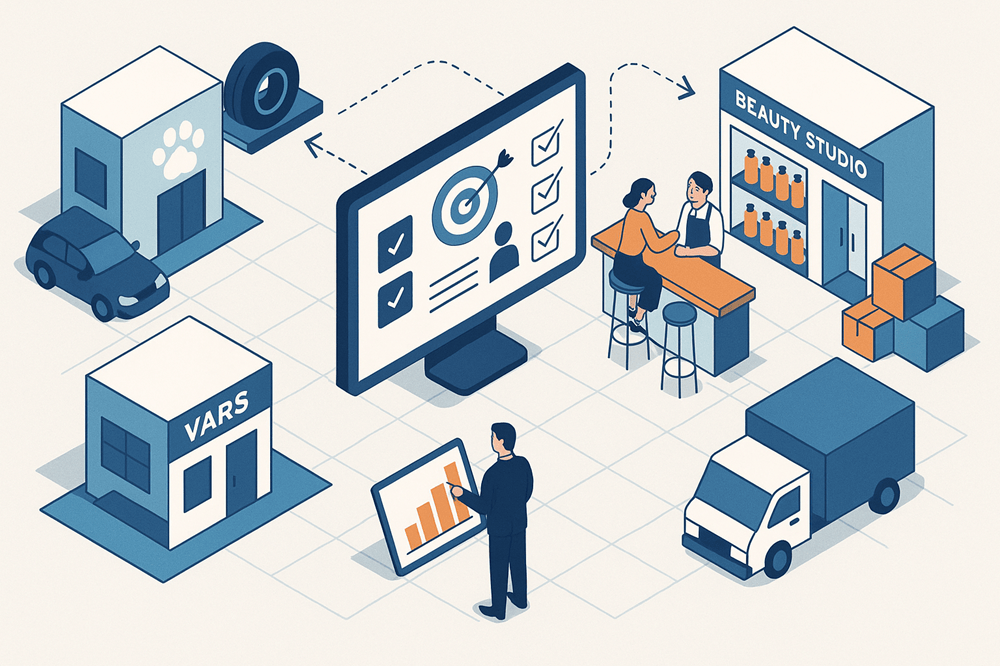

The reality is simple: across industries, brands rely on thousands of independently owned on-trade sales points. Bars, clinics, garages, vet shops, beauty studios, and more. These locations represent where buying decisions are made. Yet influencing what gets stocked, promoted, and recommended inside them remains a major challenge.

Whether you’re in FMCG, pet care, automotive, or beauty tech, there’s one shared question:

How do you achieve multi-partner engagement and activate your B2B customers to drive sell-in and sell-out without adding more reps or burning more budget?

From independent tire dealers in Brazil to off-licences in the UK, fragmented point-of-sale networks are the norm. And activating these touchpoints — digitally, at scale, with measurable ROI — requires more than traditional trade marketing.

It requires a shift in mindset.

A shift from “push more product” to “engineer partner behavior.”

A shift from manual promotions to target-based incentives.

A shift from one-size-fits-all messaging to personalized channel engagement.

This is digital trade activation.

And it’s how brands are driving growth where it matters most: at the point of sale.

Engineer Loyalty Behaviors. Not Just Tech Infrastructure

Launching a platform is not enough. Real trade activation starts when technology meets cross-functional alignment across field sales, trade marketing, channel partners, and internal teams.

And we’re not the only ones saying it.

“68% of CPG marketing leaders cite organizational silos and poor internal collaboration as the biggest hurdles to overcome.”

BCG, Uniting CPG Marketing and Sales for Collaboration and Growth

We love that BCG is spotlighting this challenge. But let’s be clear: this isn’t just a CPG issue.

Any manufacturer with distributed sales points faces the same problem.

Many brands invest in trade tech stacks. But without a plan to motivate both internal teams and partner networks, adoption stalls. To make a system work, everyone needs to be aligned on execution, incentivized to engage, and rewarded for performance.

That’s why you don’t just need a loyalty software provider. You need an activation partner.

One that knows how to apply loyalty management software to help you set the right targets, define measurable KPIs, and design loyalty mechanics that truly influence behavior, drive results.

No Two Activations Should Look Alike. And That’s the Point

No two B2B loyalty programs are the same. And they shouldn’t be.

Why? Because no two businesses aim to change the same behavior.

Your industry dynamics,

your channel structures,

your trade execution model,

regulatory limitations,

data availability,

and most importantly — your business objectives —

all shape how a channel partner loyalty program should be designed, structured, and scaled.

Whether you’re building a data-collection initiative or a multi-tiered channel incentive program, one size won’t fit all.

Let’s look at some real-world examples.

Case in Action: Royal Canin

Royal Canin wanted to reach end customers (pet owners) but without bypassing their existing partner network of breeders and veterinarians.

They couldn’t run mass marketing campaigns or offer direct promotions to consumers. So instead, they built a goal-aligned B2B2C loyalty program.

Veterinarians were rewarded for:

- Completing personalized purchase targets

- Completing product education modules

- Recommending Royal Canin products

- Collecting verified pet owner data (e.g. phone numbers, emails)

The more accurate data they submitted, the more points they earned, unlocking rewards from a digital catalog. This created a strong incentive to build better relationships with pet owners, while increasing product advocacy and sell-through.

The result? +11% incremental sales and +47% increase in customer retention.

It also allowed Royal Canin to launch targeted CRM and mid-funnel marketing initiatives based on real customer data, making loyalty a performance engine.

Just think: Can this model be copy-pasted into every sector or channel? Each environment brings its own dynamics, constraints, and engagement opportunities.

As said, no two activations are the same.

What About Spirits? Loyalty Logic at the Bar

Now, imagine you’re selling premium gin and want to engage with bars and bartenders.

At first, you might think: We don’t have a direct commercial relationship with bartenders, so how can we incentivize them?

But smart trade activation doesn’t always require a formal relationship. Just the right logic.

For instance, picture this: You’re at a bar in Bangkok ordering a gin & tonic, and the bartender asks: “Would you like to try it with the premium gin brand for a little extra? It’s smoother and more flavorful.”

That offer probably wasn’t spontaneous. More likely, it was part of a structured incentive program set up by the gin brand. Designed to drive upsell behavior behind the bar.

How might that program work?

Bartender-level incentives: Points or cash rewards based on the number of upsells tracked in the POS

Volume-based bonuses: Weekly or monthly performance targets that unlock tiered rewards

Bar-wide missions: If the bar sells X units of the gin brand in a set timeframe, the whole team earns a group prize

Event-based engagement: Promoting the gin brand during happy hours or featured cocktails in exchange for bonus rewards

In this model, bartenders become brand advocates. Without needing a formal sales contract. They are nudged to promote one product over another. Because they know what’s in it for them.

That’s what engineering behavior through smart incentive logic looks like.

Whether it’s a vet, a bartender, a garage rep, or a channel distributor, loyalty works when you reward the right action at the right moment.

And to define that moment?

You need more than technology. You need know-how.

Choose a loyalty platform provider who brings both.

From Offline Action to Measurable Impact — Why Digital Matters

Everything we’ve discussed so far — from targeted incentives to smart upsell logic — relies on one fundamental condition:

It must be digitally traceable.

Because if it’s not measurable, it’s not manageable.

And if it’s not manageable, it’s not scalable.

In traditional trade environments, most behavior still happens offline at the shelf, at the counter, or in casual interactions.

But to build a loyalty system that truly changes outcomes, you need a platform that can track those offline actions and turn them into structured data.

Let’s Take Shelf Execution as an Example

Sales reps are traditionally responsible for checking product placement or planogram compliance. But that model doesn’t scale and it doesn’t guarantee accuracy.

With a modern channel loyalty platform, brands can:

- Set Perfect Store KPIs digitally

- Let channel partners upload shelf images

- Use image verification to confirm compliance

- Reward execution without physical visits

The result?

- Reduced sales rep dependency

- Wider execution coverage

- More accurate compliance tracking

- Real-time visibility into what’s happening in-store

These micro-engagements become B2B rewards that reinforce brand-aligned behaviors, even without face-to-face sales visits.

What About Ordering?

Imagine you’re a tire manufacturer. You have hundreds of distributors and thousands of retail points, from large regional dealers to small local garages.

You want to run a promotion:

“Buy 300 tires this quarter and get 7% off.”

Sounds simple, right?

But here’s the catch:

- For big distributors, 300 tires is the standard monthly volume. → They’ll get the discount anyway without changing their behavior. → You’re sacrificing margin for no lift in sales.

- For small garages, 300 tires is completely unrealistic. → They can’t participate at all. → So they tune out future campaigns.

Now multiply this logic across 4,000+ points of sale. Promotions intended to drive behavior change end up rewarding the wrong segments or excluding the ones that need support.

So what’s the solution? Personalize the offers.

But here’s the problem: unless the right target is given to the right partner, managing that offline becomes a nightmare.

Sales reps must recall who received what discount, under which conditions, in what tier, and in what timeframe. All offline, in spreadsheets, or in the CRM. The complexity snowballs. That’s how a well-meaning incentive becomes counterproductive.

That’s where loyalty-driven B2B digital ordering (eB2B) comes in.

In fact, McKinsey notes that eB2B platforms offer fragmented point of sales a unified portal, combining product assortment, promotions, loyalty programs, and more, to address real pain points and drive adoption at scale.

By embedding incentives directly into the ordering flow, brands can precisely deliver the right offer to the right partner, at the right time, while capturing every transaction and behavior as measurable data.

With a smart platform, you can:

- Segment your partners by capacity

- Set dynamic targets personalized for each profile

- Embed campaigns directly in the online ordering interface

- Reward based on stretch behavior, not default habits

It becomes possible to reward:

- A large regional distributor for growing their volume by +10% over baseline

- A small garage for reaching a milestone that’s big for their scale

- Any partner who responds to learning modules or placement guides in the system

And because it’s all digital, you can track everything:

Who ordered what

Who earned which reward

What behavior it influenced

And what worked at scale.

So how does this play out in the real world? Let’s look at PepsiCo.

Case in Point: PepsiCo

That’s exactly what PepsiCo achieved.

By combining channel loyalty with B2B digital ordering, they activated over 500,000 traditional retailers across six markets, transforming trade relationships at scale.

They were able to:

- Set personalized goals by partner segment

- Apply dynamic discount logic based on historical volumes

- Gamify product know-how via videos, surveys, games and more

- Embed campaigns directly into the digital ordering experience

- Track redemptions and ROI; automatically

It became one of the largest implementations of a loyalty program for distributors across emerging markets.

The result?

+72% e-commerce penetration

+13% incremental sales on beverages

+19% on snacks

+57% customer retention

This level of targeting is what separates generic schemes from a true B2B loyalty program for distributors that aligns effort with reward.

And when your loyalty platform captures this level of precision and engagement, you don’t just track purchases. You capture: behavior, intent, learning, visibility, and the ability to optimize every offer.

From shelf execution to smart discounts, digital ordering isn’t just a convenience. It’s the foundation of a measurable, scalable trade activation strategy.

And Let’s Not Forget the Internal Teams

Behavioral gaps are inside your own organization. Especially when sales, marketing, and channel functions operate in silos.

Let’s go back to the BCG survey: organizational silos and poor collaboration are the biggest barriers to activation.

That’s why aligning internal incentives with B2B customer behavior is critical. Here’s how Bridgestone did it:

Case in Action: Bridgestone

Challenge:

In the automotive sector, Bridgestone needed to boost both internal sales rep performance and partner network engagement spanning dealerships, wholesalers, and local garages.

Solution:

Apex Loyalty delivered a loyalty and incentive system tailored to two layers:

- Internal sales teams received performance-based targets and digital rewards for pushing focus products.

- Channel partners (resellers and dealers) were onboarded into a gamified rewards system that motivated product knowledge, upsell activity, and campaign compliance.

This created a closed-loop incentive model that aligned internal sales goals with external partner behavior, eliminating silos and amplifying impact.

The result?

Measurable growth in product line penetration, stronger rep motivation, and unified campaign execution.

Key Takeaways

- Start with behavior, not just transactions. Define what you want to influence first.

- Make every action digitally trackable from shelf execution to online orders.

- Personalize targets based on partner profile and sales context.

- Incentivize more than transactions: learning, compliance, engagement.

- Align internal teams with external outcomes. Break the silos.

- Choose a platform that adapts to your logic, not the other way around.

Ready to Activate Your Channel?

Whether you’re trying to drive upsell at the bar, increase distributor loyalty, digitize ordering journeys, or align internal and partner teams, Apex Loyalty helps you engineer behavior where it matters most.

Let’s build the right logic, with the right tech, for the right outcomes.

Why Apex Loyalty?

Among loyalty platform providers, we stand out by combining behavioral science with deep B2B customer loyalty expertise.

Because driving behavior takes more than points and dashboards.

It takes a partner who knows how to turn complexity into action.

We bring together:

- Loyalty mechanics grounded in behavioral science

- Platform flexibility to adapt to your business model

- Industry insight across FMCG, automotive, pet care, beauty, and more.

From B2B rewards to multi-partner engagement, from shelf compliance to digital ordering, we help manufacturers influence what matters most — what happens at the point of sale.